تقديرات أسعار الأنودة بالقوس الكهربائي: عوامل التكلفة ورؤى السوق

مقدمة حول تكاليف الأنودة القوسية

بصفتي مهندسًا في Neway، أدعم العملاء بشكل متكرر عند تقييم فروقات الأسعار بين خيارات معالجة السطح المختلفة. تقع الأنودة القوسية—المعروفة أيضًا بالأكسدة بالميكرو-قوس (MAO) أو الأكسدة الكهربية البلازمية (PEO)—ضمن الطرف الأعلى من طيف تكاليف الأنودة. والسبب بسيط: فالأنودة القوسية تُحوِّل سطح المعدن إلى طبقة خزفية كثيفة عبر تفريغات بلازمية، ما يتطلب طاقة أعلى وكيمياء أكثر تحكمًا ومعدات متخصصة.

في السوق الصناعي اليوم، لا تتحدد الأسعار بمعايير العملية فقط، بل تتأثر أيضًا بطرق التصنيع السابقة مثل صب الألومنيوم بالقوالب، واختيار السبيكة، والمعالجات اللاحقة. يوضح هذا المقال أهم محركات التكلفة، ورؤى السوق، والاستراتيجيات العملية التي يمكن للشركات استخدامها لتحسين التكلفة الإجمالية للملكية.

محركات التكلفة الأساسية في الأنودة القوسية

حجم الجزء، والهندسة، ومساحة السطح

أكثر عوامل التسعير مباشرة هو مساحة الطلاء. تتطلب الأجزاء الأكبر والهندسات المعقدة وقت أكسدة أطول وطاقة أعلى لتحقيق تفريغ بلازمي مستقر. كما أن الميزات مثل الجيوب العميقة وقنوات التبريد قد تُسبب توزيعًا غير متجانس للقوس، ما يستلزم تعديلات يدوية أو دورات معالجة أطول.

نوع السبيكة والاستجابة المعدنية

تُظهر السبائك سلوكًا متفاوتًا أثناء الأنودة القوسية. فالسبائك المصبوبة عالية السيليكون مثل ألومنيوم A380 أو سبيكة ADC12 تتطلب جهودًا أعلى وتُنتج نشاط تفريغ أشد، وبالتالي ترفع استهلاك الطاقة. أما السبائك المشغولة فعادةً تكون أقل تكلفة بسبب استقرار القوس بشكل أفضل. وعلى الجانب الآخر، قد تُدخل مكونات المغنيسيوم أو الزنك ذات الجدران الرقيقة مخاطر تركّز حراري وتتطلب ضبطًا إضافيًا للمعايير.

سماكة الطلاء، وفئة الصلادة، والمسامية

الطلاءات الخزفية الصلبة—المستخدمة عادةً في الطيران وإلكترونيات القدرة—تستغرق وقتًا أطول للتكوّن. إن زيادة السماكة وتشديد متطلبات المسامية يرفعان استهلاك الكهرباء وقد يتطلبان أكثر من تمريرة معالجة. أما طلاءات MAO الزخرفية فتكون أقل تكلفة لأنها أرق وتتطلب زمن تعريض أقصر.

نمط مزود الطاقة والحمل الطاقي

يُعد MAO بالتيار المستمر (DC) الأكثر استهلاكًا للطاقة. وتساعد الأنماط النبضية أو الهجينة على تحسين دورات التفريغ، لكنها لا تزال تتطلب إدخالًا كهربائيًا كبيرًا، خصوصًا مع سبائك مثل AlSi10Mg. يؤثر اختيار مزود الطاقة في كلٍ من جودة الطلاء والسعر.

تركيب الإلكتروليت وصيانة الحمام

ترفع الإلكتروليتات التي تحتوي على سيليكات أو ألومينات أو إضافات خاصة من تكلفة المواد الاستهلاكية. كما ترفع أنظمة تبريد الحمام من المصاريف التشغيلية، خاصة في الإنتاج واسع النطاق.

تأثيرات السعر المرتبطة بالمادة

السبائك عالية السيليكون مقابل السبائك المشغولة

تتطلب سبائك الصب ذات السيليكون المرتفع وقتًا أطول لاستقرار عملية القوس. على سبيل المثال، فإن سبائك الألومنيوم التي تتجاوز نسبة السيليكون فيها 8–10% تزيد تعقيد الطلاء وحمل الطاقة، ما يرفع سعر الوحدة مباشرة.

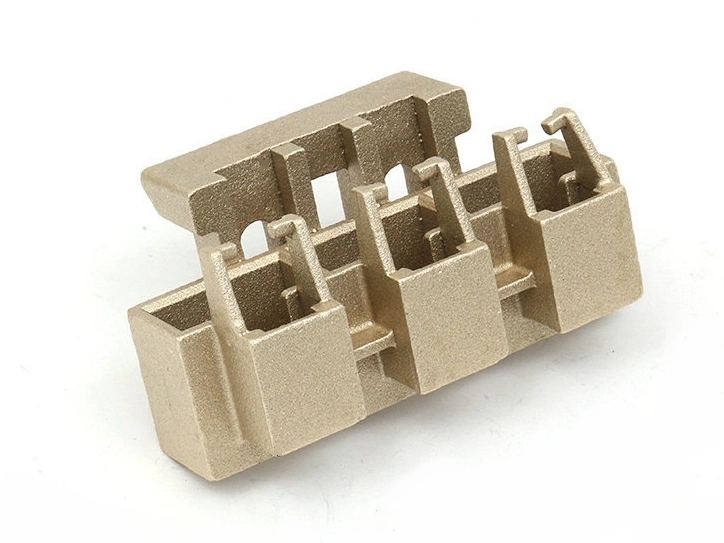

الأجزاء المصبوبة بالقوالب ذات الجدران الرقيقة

تكون المقاطع الرقيقة أكثر عرضة لارتفاع الحرارة، ما يفرض على المشغل تقليل معدلات رفع الجهد وإطالة زمن الأكسدة. وقد تتطلب الأجزاء المصنّعة عبر صب الزنك بالقوالب أو صب النحاس بالقوالب دورات تبريد أو تجهيزات تثبيت مخصصة.

تفاوت أداء السبائك

تُظهر سبائك الزنك والنحاس سلوكًا مميزًا أثناء الأكسدة البلازمية. فمثلًا، تتطلب سبائك الزنك غالبًا دورات أقصر لكنها قد تُعرّض السطح للانصهار إذا لم تُضبط المعايير جيدًا. أما سبائك النحاس فتتطلب إلكتروليتات معدّلة لتثبيت تشكيل البلازما. تؤثر هذه الفروقات في السعر.

تدفق العملية وتفصيل التكاليف التشغيلية

المعالجة المسبقة وتنشيط السطح

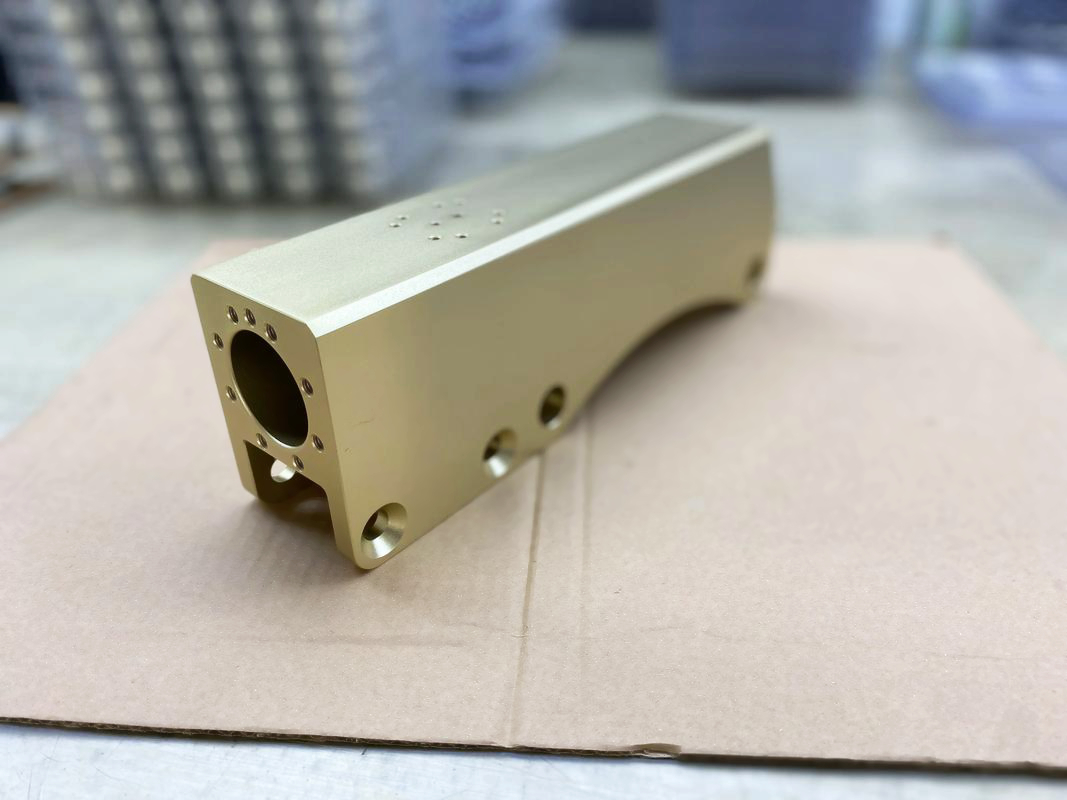

يضمن التحضير السطحي الصحيح استقرار تكوين القوس. تشمل المعالجات المسبقة: السفع، وإزالة الشحوم، والتنظيف، والتنشيط. عادةً ما تحتاج المكونات المصنّعة عبر التشغيل باستخدام CNC تصحيحًا سطحيًا أقل مقارنةً بالمسبوكات ذات القوام الخشن.

مرحلة التفريغ: الوقت والطاقة والمعدات

تنشأ غالبية التكلفة من مرحلة الأكسدة. تستهلك التفريغات البلازمية طاقة كبيرة، خصوصًا عند تكوين طبقات سميكة أو معالجة مكونات كبيرة. كما يساهم تبريد الإلكتروليت والتحكم بدرجة الحرارة في إجمالي النفقات التشغيلية.

المعالجة اللاحقة: السدّ/الختم، والتلوين، والتشطيب

تعزز المعالجات اللاحقة المتانة والمظهر. وقد تخضع بعض المكونات لخطوات إضافية مثل أنودة المسبوكات بالقوالب أو عمليات السدّ لتحسين العزل الكهربائي. كل خطوة إضافية تؤثر في السعر النهائي.

التكامل مع الصب بالقوالب والنمذجة الأولية

يساعد دمج طرق التصنيع السابقة مثل النمذجة السريعة مع MAO على خفض التكاليف في المراحل المبكرة، خاصةً عند التحقق من ميزات التصميم التي تؤثر في سلوك الطلاء. أما في الإنتاج، فإن اختيار مورد يقدم سلسلة كاملة—مثل خدمة الصب بالقوالب الشاملة لدينا—يقلل اللوجستيات وإخفاقات الطلاء ومعدلات الهدر.

رؤى السوق وفروقات التسعير الإقليمية

تفاوت التكلفة حسب المنطقة

تختلف أسعار MAO بين الأسواق مثل الصين والاتحاد الأوروبي وأمريكا الشمالية. تُعد تكلفة الكهرباء محركًا رئيسيًا؛ فالمناطق ذات أسعار الطاقة الأعلى تُظهر تسعيرًا أعلى لـ MAO بصورة متناسبة. كما تؤثر أجور العمالة في التكلفة التشغيلية.

التسعير حسب الصناعة

تتطلب صناعات مثل مكوّنات الطيران معايير جودة مُعززة، والتحقق من المسامية الدقيقة، واختبارات إضافية للعزل الكهربائي، وكل ذلك يرفع التكلفة. بالمقابل، غالبًا ما تُركز أغلفة الإلكترونيات الاستهلاكية—مثل تلك المصنّعة لمكوّنات Huawei المخصصة—على تجانس المظهر وطلاءات رقيقة، ما يؤدي إلى أسعار أقل لكل وحدة.

الاتجاهات الاقتصادية واتجاهات المواد

تؤثر أسعار المعادن وتقلبات توريد المواد الكيميائية والطلب العالمي على المكونات المطلية في تسعير السوق. وعندما ترتفع أسعار الطاقة، ترتفع أسعار MAO بشكل متناسب.

فرص خفض التكلفة

اختيار السبيكة المناسبة

يساهم اختيار سبائك ذات سلوك أكسدة مستقر في خفض تكاليف الطلاء بشكل كبير. عادةً ما تنتج التركيبات المشغولة من الألومنيوم طلاءات أكثر نعومة مع إدخال طاقة أقل. كما أن المسبوكات الناتجة عن تحكم محسن في الصهر—مثل حلول صب السيارات—تقلل أيضًا تكاليف تحضير السطح.

المعالجة على دفعات وكفاءة الحجم

تقلل معالجة عدة أجزاء في وقت واحد من تكلفة الطاقة واستهلاك الإلكتروليت لكل وحدة. وتحقق برامج MAO ذات الأحجام الكبيرة أفضل نسبة تكلفة إلى أداء.

التصميم للأنودة القوسية (DFAA)

يساعد تحسين التصميم على رفع تجانس الطلاء. إن تقليل الحواف الحادة، وإزالة الجيوب العميقة غير الضرورية، أو موازنة سماكة الجدار يمكن أن يخفض وقت الأكسدة والتكلفة بشكل ملحوظ.

اختيار المورد المناسب

تقييم المورد

بالنسبة للبرامج الحساسة للتكلفة، من المهم تقييم حجم معدات المورد، وإدارة الإلكتروليت، وقدرات ضبط الجودة، والتكامل مع العمليات السابقة مثل الصب بالقوالب والتشغيل.

مزايا التصنيع المتكامل

عندما تُقرن MAO مع الصب والتشغيل والتجميع لدى مورد واحد، تتحسن الكفاءة بشكل كبير. ويمكن للمكونات المصنّعة عبر صب النحاس بالقوالب أو صب الزنك الانتقال مباشرةً إلى MAO مع حد أدنى من التوقفات اللوجستية.

TCO (إجمالي تكلفة الملكية)

رغم أن الأنودة القوسية قد تبدو مرتفعة التكلفة لكل وحدة، إلا أن متانتها تقلل الأعطال والصيانة. وعند احتساب دورة الحياة بالكامل، غالبًا ما تكون MAO الخيار الأكثر اقتصادًا للتطبيقات المتطلبة.

الخلاصة

يتحدد تسعير الأنودة القوسية عبر متغيرات هندسية وتشغيلية متعددة: تركيب السبيكة، وسماكة الطلاء، وهندسة السطح، واستهلاك الطاقة، ومستوى الأداء المطلوب. كما تؤثر فروقات الأسواق والمعايير الصناعية في التكلفة. ومع اعتبارات تصميم مناسبة ودعم شريك تصنيع متكامل، يمكن للمشترين تحقيق تسعير متوقع وجودة طلاء مستقرة من النموذج الأولي إلى الإنتاج الكمي.